An adjusted form for the VAT return 2025 (German abbreviated: USt-VA) was published.

Current state

The form and the instructions for 2025 have been finalized.

The form together with the instruction was published by the Federal Ministry of Finance (German abbreviated: BMF) on December 9th, 2024. It has been available to developers in the protected ELSTER developer area since June 2024.

Overview

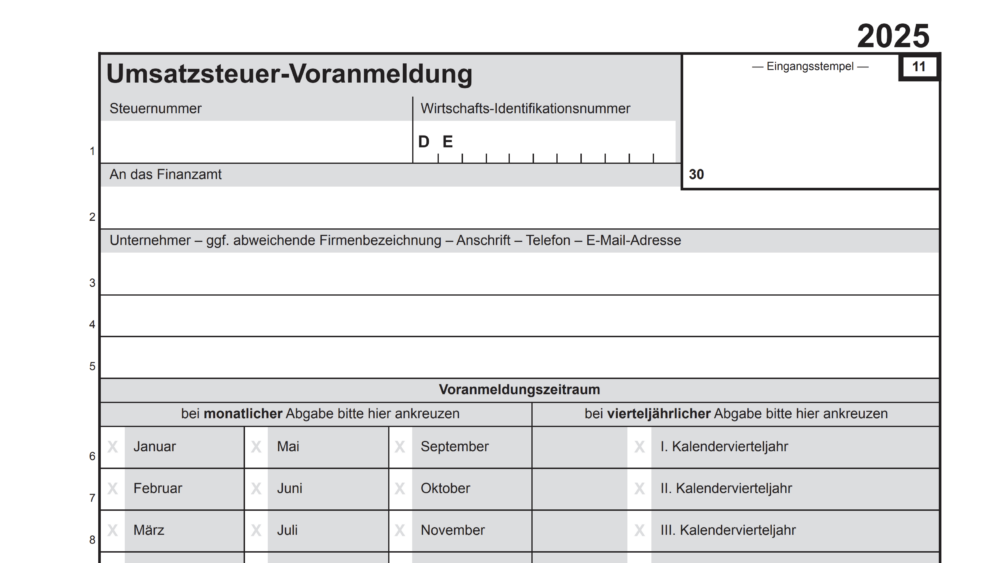

The main changes to the VAT return form 2025 are:

- new field code 70 (date of change from the small business regulation to standard taxation)

- new field for the Economic-ID (German: Wirtschafts-Identifikationsnummer, initially optional until the end of 2026)

Besides that, changes are only of an editorial or printing nature.

The instructions have been supplemented with regard to the Economic-ID, the new field code 70 (line 12) and the field code 48 (line 23).

ELSTER ERiC libraries

On October 21st, 2024, the so-called BETA version of the ERiC libraries with the corresponding plugin for USt-VA 2025 was published. The productive plugin was released on November 25th, 2024. With the plugin, productive transmission should be possible as of January 1st, 2025.

Download

The form and the adapted instructions (dated December 9th, 2024) can be accessed under the following link:

BMF-Schreiben vom 09.12.2024 (GZ: III C 3 – S 7344/19/10001 :006, DOK: 2024/1007955)

Do you need an ELSTER API connection?

Recht logisch specializes in tax APIs in Germany. The company supports software manufacturers in the process of connecting their software to the ELSTER API and developed a state-of-the-art solution for this purpose.

Feel free to contact Krzysztof Tomasz Zembrowski in case of questions concerning the ELSTER ERiC API.

Comments are closed.